See accompanying notes to financial statements.

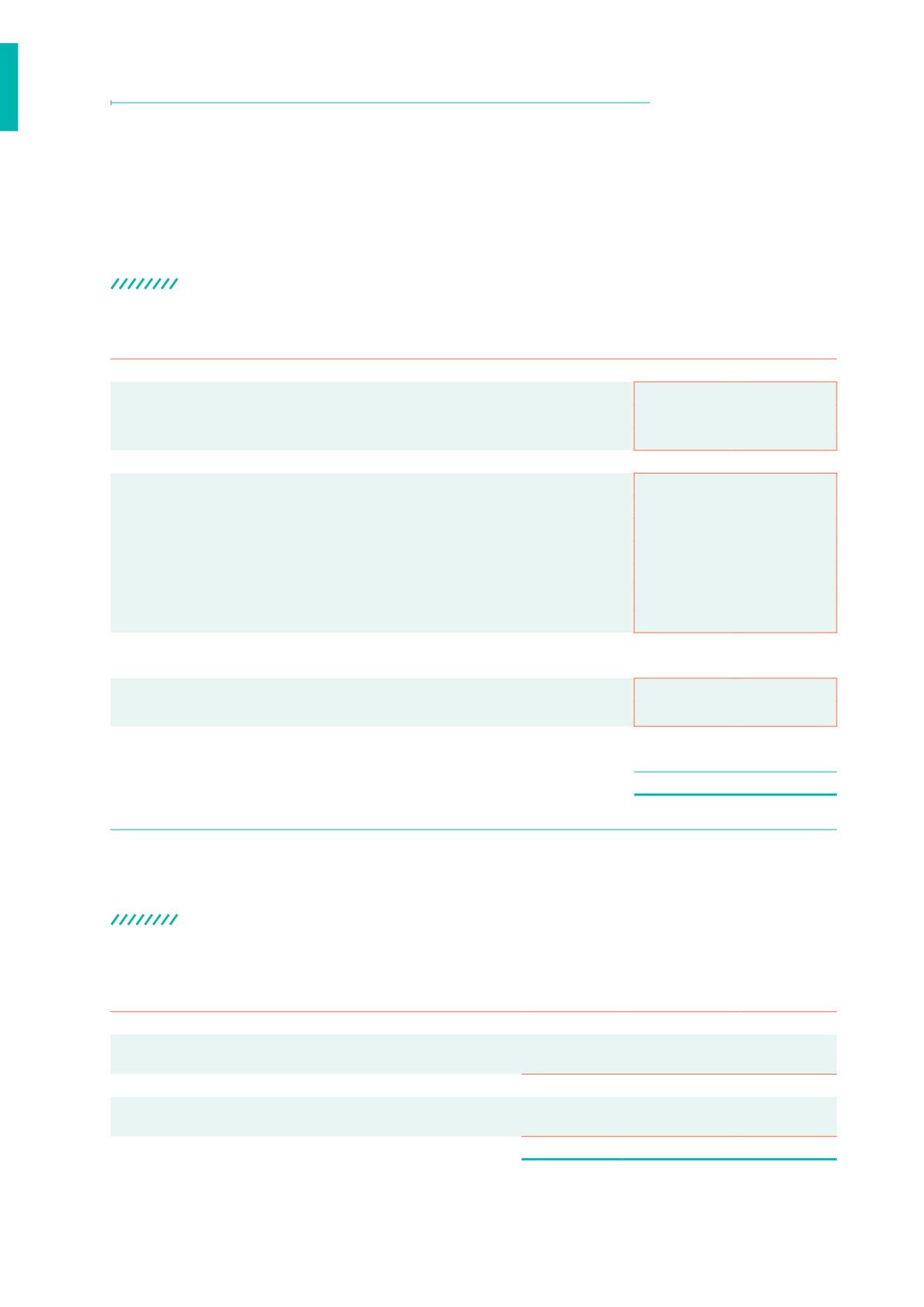

STATEMENT OF PROFIT OR LOSS AND

OTHER COMPREHENSIVE INCOME

STATEMENT OF CHANGES IN EQUITY

YEAR ENDED 31 MARCH 2016

YEAR ENDED 31 MARCH 2016

SHARE

CAPITAL

ACCUMULATED

SURPLUS

TOTAL

$

$

$

Balance as at 1 April 2014

2,097,892

17,586,215

19,684,107

Net deficit for the year, representing total comprehensive loss for

the year

-

(330,089)

(330,089)

Balance as at 31 March 2015

2,097,892

17,256,126

19,354,018

Net deficit for the year, representing total comprehensive loss for

the year

-

(343,155)

(343,155)

Balance as at 31 March 2016

2,097,892

16,912,971

19,010,863

NOTE

2016

2015

$

$

Revenue

14

464,508

729,819

Interest income

222,673

184,090

Application fee income

170,000

535,000

Other operating income

71,835

10,729

Expenditure

(16,342,660)

(15,723,629)

Depreciation of plant and equipment

8

(577,471)

(600,541)

Amortisation of intangible assets

9

(133,903)

(95,393)

Salaries, wages and staff benefits

15

(10,769,972)

(9,475,351)

Staff training and development costs

(489,156)

(492,763)

Information technology expenses

(1,313,264)

(1,331,684)

Operating lease expenses

15

(1,324,556)

(1,316,420)

Other operating expenses

(1,734,338)

(2,411,477)

Deficit before government grants

(15,878,152)

(14,993,810)

Government grants

15,534,997 14,663,721

Operating grants

16

15,227,443 14,395,489

Deferred capital grant amortised

12

307,554

268,232

Deficit before contribution to consolidated fund

15

(343,155)

(330,089)

Contribution to consolidated fund

11

-

-

Net deficit, representing total comprehensive loss for the year

(343,155)

(330,089)

82

FINANCIAL STATEMENTS

CCS ANNUAL REPORT 2015-2016