The Parties are:

a Avallis Financial Pte Ltd,

formerly First Principal

Financial Pte Ltd (“Avallis”);

b CornerstonePlannersPteLtd

(“Cornerstone”);

c Financial Alliance Pte Ltd

(“Financial Alliance”);

d Frontier WealthManagement

Pte Ltd (“Frontier”);

e IPPFinancialAdvisersPteLtd

(“IPP”);

f JPARA Solutions Pte Ltd

(“JPARA”);

g Professional Investment

Advisory Services Pte Ltd

(“PIAS”);

h Promiseland IndependentPte

Ltd (“Promiseland”);

i RAY Alliance Financial

Advisers Pte Ltd (“RAY”); and

j WYNNES Financial Advisers

Pte Ltd (“WYNNES”)

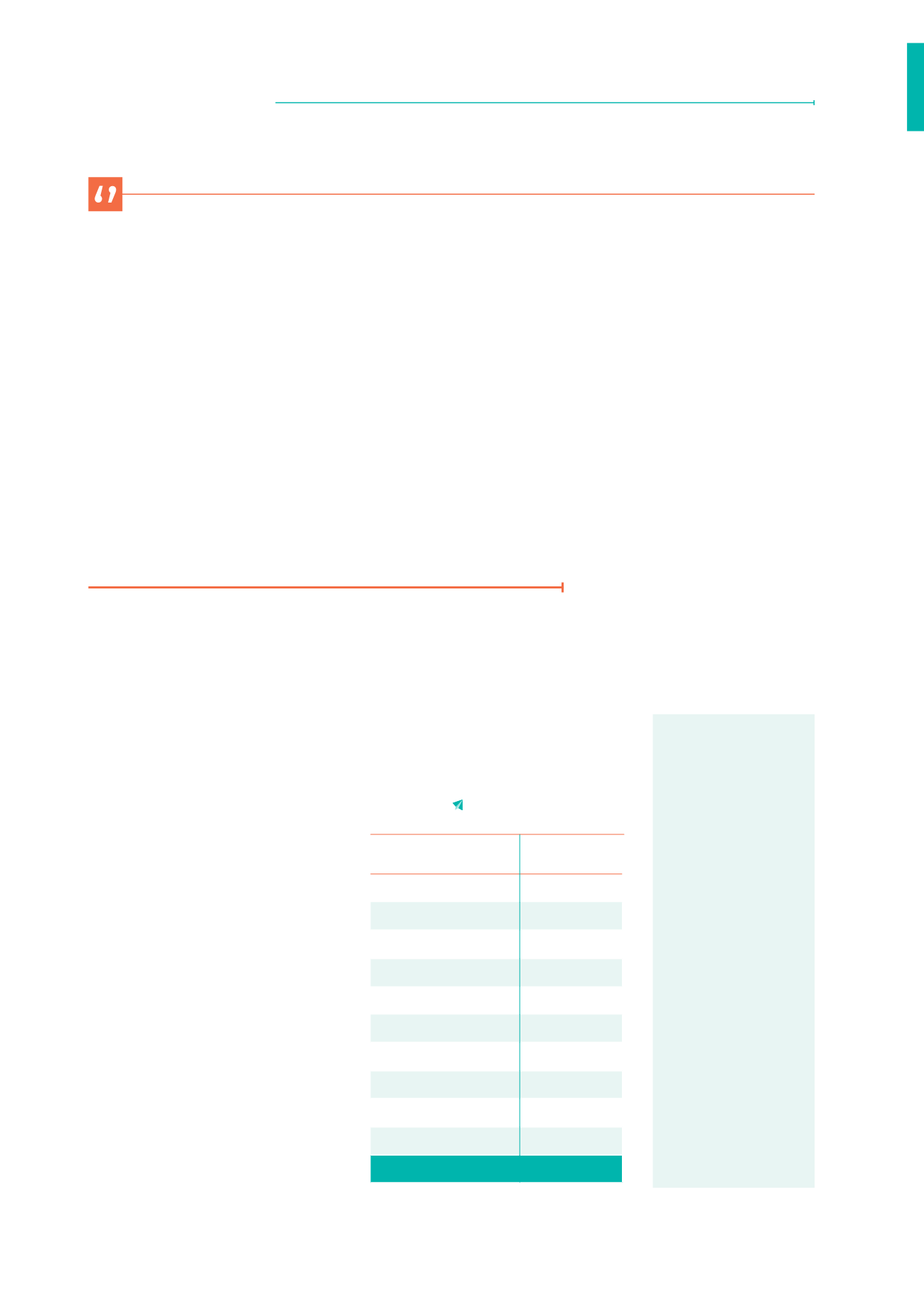

PARTY

FINANCIAL

PENALTY

Avallis

S$54,788

Cornerstone

S$13,781

Financial Alliance

S$137,524

Frontier

S$5,000

IPP

S$239,851

JPARA

S$5,000

PIAS

S$405,114

Promiseland

S$31,305

RAY

S$11,939

WYNNES

S$5,000

TOTAL

S$909,302

This was also shortly after CCS issued

a Proposed Infringement Decision to the

Parties which was publicised.

CCS found that the Parties’ conduct to

prevent a competitor from providing

a lower-cost offer to consumers not

only restricted, but was also likely to

have an adverse effect on competition

in the market. The Parties’ commercial

relationship with iFAST in its unit trust

business contributed significantly to

iFAST’s revenues and placed them in a

position to exert pressure on iFAST. CCS

furthernotedthat theFundsupermartOffer

was particularly attractive to customers

because the general industry practice

of financial advisers is to not provide

commission rebates to policyholders.

In terms of market impact, iFAST

has a wide client base of over 50,000

through

Fundsupermart.comand can

reach out to other visitors as well. The

traffic at

Fundsupermart.com, including

direct e-mailers and regular visitors, is

estimated to reach up to over 100,000

over a fewmonths. Some of the Parties

themselves had expressed their concern

The Fundsupermart Offer was an innovative one that allowed iFAST to reach out

to awide client base through an established online platform, save on distribution

costs,andpassonthesecostsavingstoconsumersthroughasignificantcommission

rebate. The parties’ conduct to collectively pressurise iFAST into withdrawing the

Fundsupermart Offer prevented the life insurancemarket fromshifting to amore

competitive state.

Agreements between competitors to collectively pressurise a competitor to

withdrawan offering can constitute anti-competitive conduct. Businesses should

instead determine their own individual responses to competition. CCSwill enforce

the law, where necessary, to ensure that new and innovative players can access

markets and compete fairly.

about their own customers switching

to iFAST or seeking from them rebates

similar to those offered by iFAST. Had

iFAST’s offer remained on themarket, the

Partiesmight have had tomake similar or

new offers to respond to the competitive

threat of commission rebates from the

Fundsupermart Offer. The following

financial penalties were imposed on

the Parties:

CCS Chief Executive,

Mr Toh Han Li

33

CCS ANNUAL REPORT 2015-2016

GUIDING YOU TO NEW HEIGHTS